Lin Yifu, an economist at Peking University’s China Center for Economic Research, recently proposed that China has already accumulated the world’s largest foreign exchange reserves. Moreover, under the continuous average annual growth rate of 9.6% of gross domestic product and the tendency toward high savings, funds have also emerged. Relatively rich. The foundations of foreign investment and foreign trade policies have undergone great changes. The policies formed under the "double-shortage" conditions no longer meet the needs of China's current economic development. Foreign and foreign trade policies should be adjusted accordingly and repositioned. At present, China's production, finance, and foreign trade are all in a relatively relaxed environment. This is an opportune time for the adjustment of foreign investment and foreign trade policies.

In recent years, China’s foreign exchange reserves have increased very rapidly. By the end of 2000, it was US$165.57 billion, and by the end of 2005 it was US$818.87 billion, an average annual increase of 37.7%. By the end of March this year, China’s foreign exchange reserves had reached US$875.1 billion, surpassing Japan as the world’s largest foreign exchange reserve country. Experts predict that by the end of this year will reach 100 billion US dollars.

Lin Yifu believes that the increase in foreign exchange reserves comes from the surplus of capital account and current account. The huge surplus of these two accounts is not only related to the economic characteristics of China's current development stage, but also related to China's existing foreign investment and foreign trade policies. The basic framework of China’s existing foreign trade and foreign investment policies was formed in the early days of reform and opening up. In the early 1980s, China was a typical “double-gap†developing economy that lacked both funds and foreign exchange. In order to earn more foreign exchange and overcome the bottleneck of the foreign exchange gap on China's economic development, since 1985, the Chinese government has adopted export tax rebate policies to encourage exports. Similarly, in order to fill the funding gap, in the initial period of reform and opening up, China has also adopted a policy of encouraging foreign direct investment, giving foreign-funded enterprises many preferential policies, including “two exemptions and three reductions†on taxation, and the income tax is only about half that of similar domestic companies. Under the stimulation of these policies, China’s foreign trade grew very fast, with an average annual growth rate of 17% between 1978 and 2005, which was more than double the world’s growth rate of 8% in the same period, and foreign trade increased by 68 times in 27 years; It also became the country that attracted the most foreign investment except the United States.

However, since 1994, our country’s current account and capital account have experienced double surpluses every year, and now they have accumulated the world’s largest foreign exchange reserves; and, in consecutive 27 years, GDP has grown at an average annual rate of 9.6% and high savings. As a result, China’s funds have also appeared relatively surplus. In terms of foreign trade policy, the export tax rebate policy that has been implemented since the mid-1980s was aimed at encouraging exports and earning more foreign exchange. Now that foreign exchange is no longer in short supply, according to Lin Yifu, the basis for foreign investment and foreign trade policies has been established. Great changes have taken place. The policies that have been formed under the "double-gap" conditions are no longer suited to the needs of the current economic development. Therefore, it is necessary to make corresponding adjustments and repositioning of these policies. Foreign trade policies should be aimed at encouraging Chinese enterprises to use domestic and foreign markets to achieve optimal allocation of resources.

He clearly stated that China is a country with a shortage of resources, land and energy, and a relatively fragile environment. Therefore, it is necessary to reduce or gradually eliminate tax rebates on exports of resource-intensive, land-intensive, energy-intensive and highly polluting products so that our enterprises will have less Developing and exporting these products will help improve China's resource allocation and improve the quality of economic development.

In terms of foreign investment policy, Lin Yifu said that in the past, any preferential policy for foreign investment to obtain half of the income tax and “three exemptions and two reductions†was aimed at introducing more funds. Now the funds are no longer the main bottleneck of China’s economic development. Therefore, the foreign investment policy should be changed to attract high-tech that is not essential to the country and is crucial to China's economic development. Specifically, the “two-tax integration†should be implemented to unify the income tax rate and taxation policy of domestic and foreign-funded enterprises, eliminate the current policy of differential treatment between domestic and foreign-funded enterprises, and replace them with industries with different technical standards. policy. He believes that after cancelling the super-national treatment of foreign-funded enterprises, it is not possible to encourage foreign-funded enterprises that are of significance to China’s economic development to invest in China. He said that as long as the thresholds for industry access and high-tech standards are clearly defined. Still, it can give foreign investors incentives that need encouragement. Of course, if domestic companies in the future reach the same technical standards, they should also receive preferential treatment as long as this preferential policy is still in place. However, since the purpose of the concession is to encourage high-tech companies that are not available in China to invest, they should rise by the time and raise the threshold for concessions. Such a foreign investment policy does not violate the principle of national treatment, but also can more effectively encourage foreign-funded enterprises with advanced technology to invest and promote the faster and better development of China's economy.

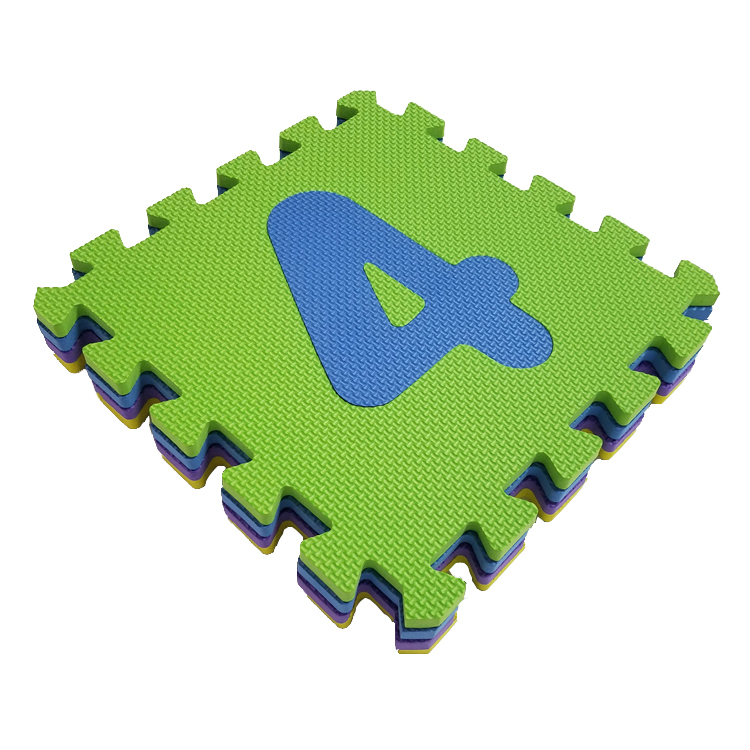

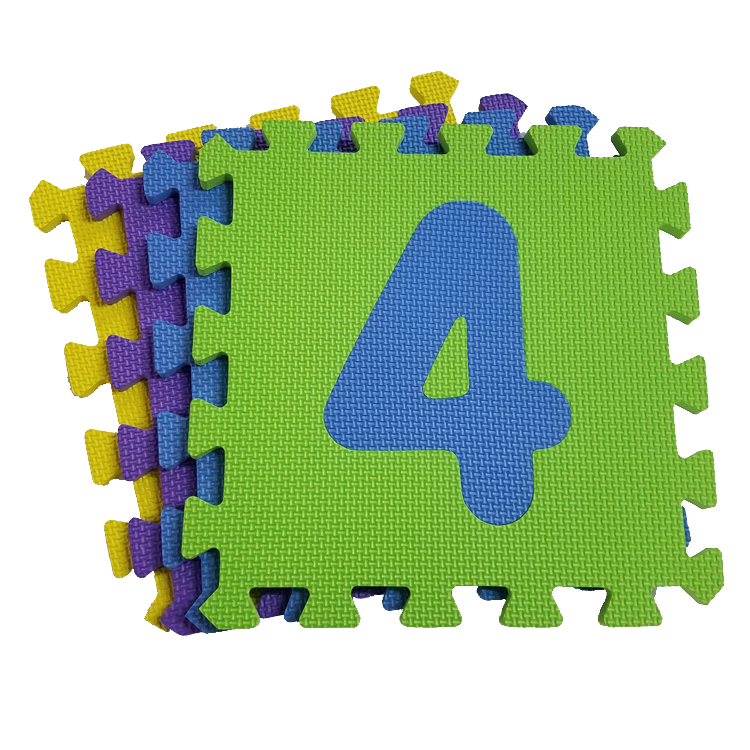

Numbers Puzzle Mat has a total of 10 pieces (No border) which includes numbers 0-9.

It is a great EVA Puzzle Mat for kids because the removable pieces allow kids to develop gross motor skills, hand-eye coordination, logic, reasoning, and visual sensory growth. This mat can be used to design play areas in homes, schools, day cares, and many more places. The top of the puzzle mat is grooved with a non-skid bottom for ultimate safety and protection. An awesome baby play mat for hard floors and soft heads! It is made out of high density EVA foam for the greatest durability and comfort. EVA foam is durable, non-toxic, premium foam that is lightweight and easy to assemble. It is also water, mold and mildew resistant which makes it easy to clean.

Numbers Puzzle Mat,Numbers Jigsaw Mat,Eva Number Puzzle Mat,Foam Puzzle Mats,Eva Interlocking Mats,Foam Number Puzzle Mats

Huizhou City Melors Plastic Products Co., Limited , https://www.thefoammaster.com